Why does governance of Hokuetsu need to be transformed now?

During Mr. Kishimoto’s 16 years as CEO, Hokuetsu has:

Failed to have effective corporate governance

Failed to realize fruitful synergies with Daio Paper

Resurrected a Poison Pill, which is detrimental to shareholder interests

Consistently eliminated potential successors for managerial positions

Consistently failed to hit many of their earnings targets year after year

And yet Mr. Kishimoto’s total control over decision-making continues. The Board should be held accountable NOW for his and its failures.

Oasis will vote to remove Mr. Kishimoto and incumbent “independent” directors, and has nominated five new highly qualified, independent and diverse directors at the upcoming AGM.

**

Why Shareholders Should Remove Mr. Kishimoto and Current “Independent” Directors NOW, please see:

Reason 1: Resurrected Poison Pill to Protect Their Vested Interests

Mr. Kishimoto and “Independent” Directors have Resurrected a Poison Pill to Protect His Vested Interests

Mr. Kishimoto has resurrected a Poison Pill that Hokuetsu itself abolished in June 2022, to protect his vested interests

The Board of Directors made a unanimous decision to support the reinstatement of the poison pill. Independent directors thus failed to perform their duties, raising concerns about their independence and integrity

Therefore, Oasis proposes to remove Mr. Kishimoto and four current independent directors from the Board of Directors and proposes a slate of truly independent and qualified candidates

Hokuetsu had decided to discontinue its poison pill in May 2022. However, Hokuetsu then decided to reintroduce such plan because Mr. Kishimoto viewed Daio Kaiun as a potential threat to his controlling position

Oasis believes that institutional shareholders are against the poison pill, and that there is a trend to abolish such poison pill plans. Thus, we view its reinstatement as evidence of a fundamental failure of corporate governance

Hokuetsu’s Poison Pill Goes Against the Corporate Governance Trend in Japan

Japan is on its way to introducing appropriate and effective corporate governance to increase value

As a part of improved corporate governance, there is a trend in reduction of the number of companies that introduce takeover defense measures

Mr. Kishimoto and the Hokeuetsu “independent” directors are going against this trend by unanimously reintroducing a Poison Pill to protect their vested interests, which is a detriment to shareholder interests

Reason 2: History of Failure to Realize Synergies with Daio Paper and Refusal to Sell its Strategic Shareholdings, incurring Significant Economic Loss

Hokuetsu’s Refusal to Sell its Daio Cross-Shareholdings Led to a

JPY40Bn Loss

in Economic Value to Hokuetsu & Its Stakeholders

Hokuetsu’s Return From Its JPY ~33Bn Daio Investment is Only JPY ~6Bn over 18 Years

Hokuetsu has made only JPY ~6bn in return, while its total investment in Daio Paper shares is JPY ~33bn

This means that Hokuetsu has made a 17% return over 18 years, or an 1.0% return on an annual basis

There is no objective reason for Hokuetsu to use such a substantial amount of its balance sheet on an investment that produces such a low annual return

Simply Investing in TOPIX Would Have Been a Better Investment For Hokuetsu

Hokuetsu share value and dividends received from Daio Paper amount to ~53 Bn JPY against a ~33 Bn JPY investment. This means the absolute return from Hokuetsu’s investment in Daio Paper is +62%.

An investment in TOPIX over the same period would have returned ~72 Bn JPY, yielding a +119% return

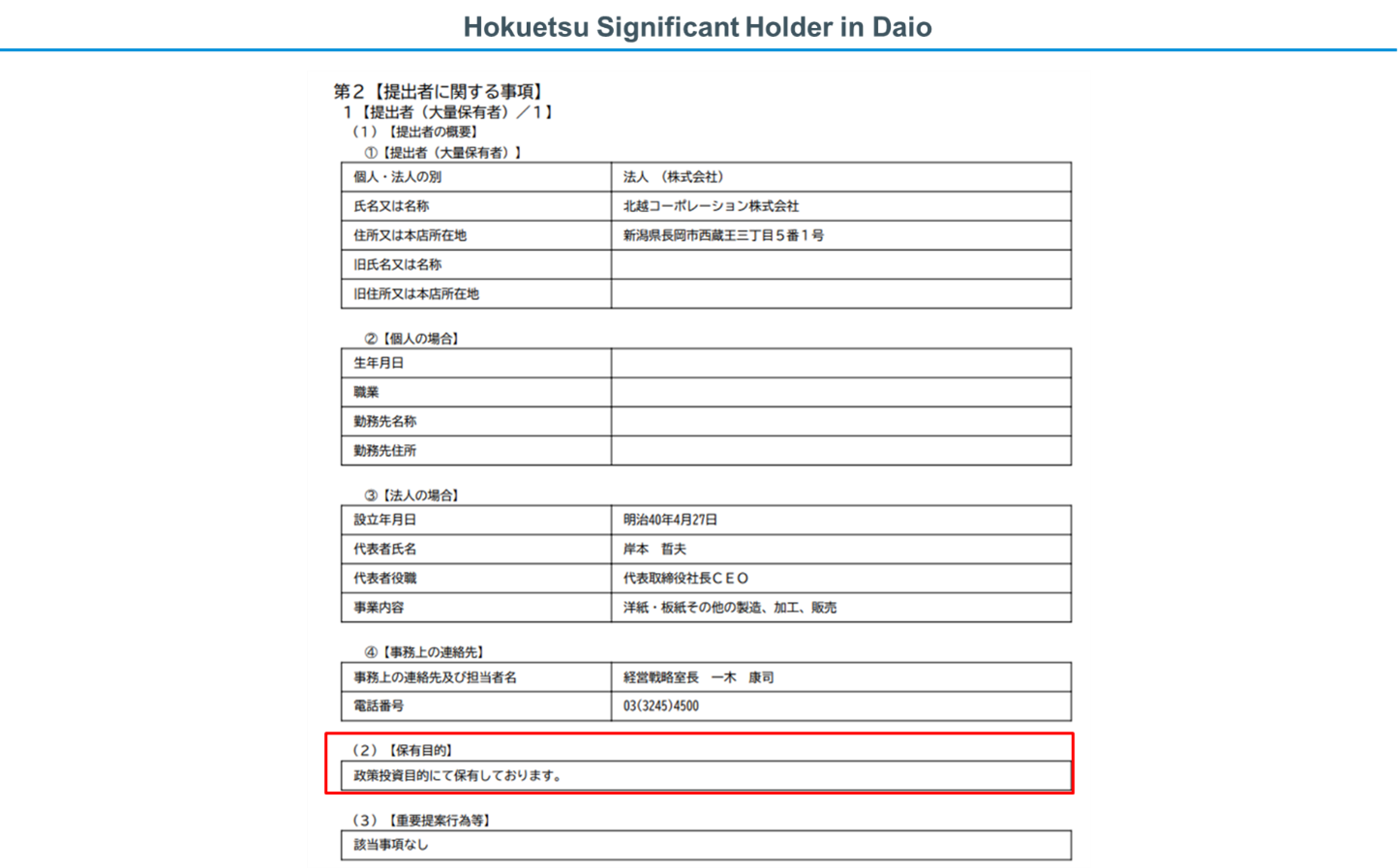

Hokuetsu Explicitly Mentions the Purpose of Holding Daio Paper Shares as “Cross-Shareholdings” in Its Significant Holder Disclosure

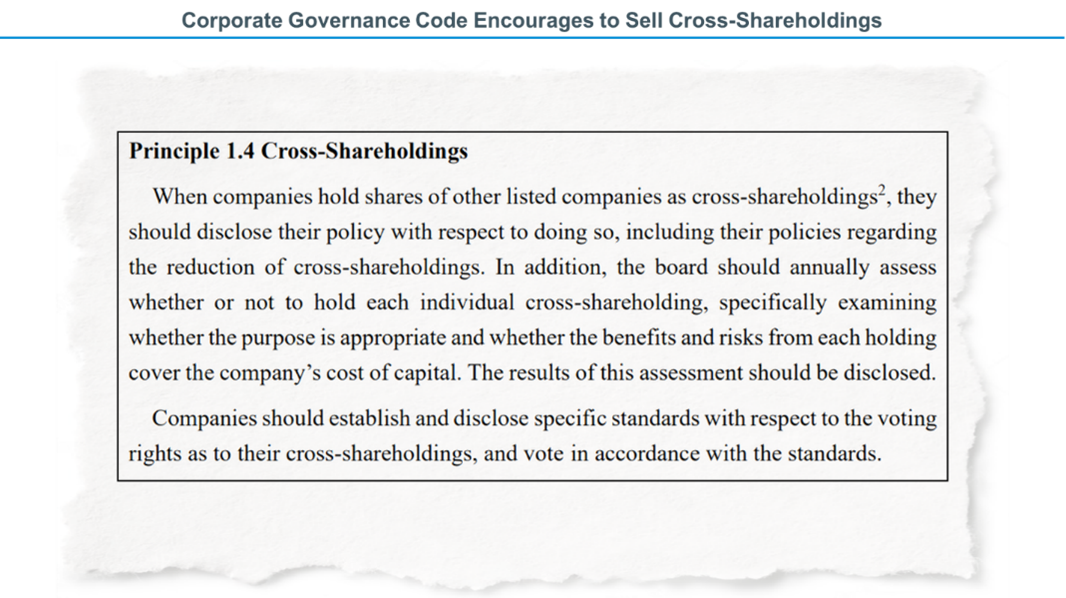

Japan’s Corporate Governance Code Encourages the Sale of Cross-Shareholdings

The Corporate Governance Code encourages the sale of cross-shareholdings

ISS & Glass Lewis Recommend Voting AGAINST CEOs with Significant Cross-Shareholdings

Reason 3: Announced Strategic Alliance with Daio Paper; However, Due To Regulatory Constraints and Inherent Conflicts of Interest, Anticipated Economic Benefits are Limited

Mr. Kishimoto Made Reckless Claims For “Strategic Business Alliance” and Against Considering Consolidation with Daio Paper

Reason 4: Sub-par Performance During Extremely Long Tenures

Mr. Kishimoto Has Held His Role for 16 Years

CEO Mr. Kishimoto (78) has served as a Hokuetsu Board member for 25 years and as CEO for 16 years

The Company deserves a new CEO to execute a bold new plan to secure Hokuetsu’s future

Mr. Kishimoto Has Failed to Deliver on Almost ALL of His Promises Over the Past Decade

Mr. Kishimoto Fired All Younger Directors in What Appears to be an Effort to Preserve His Leadership

Since Mr. Kishimoto became CEO in 2008, he has fired all the other senior directors in order to preserve his role and maintain his rule over the Company

Mr. Iwata and Mr. Nakase (whose prior experience was at the Mitsubishi Group, same as Mr. Kishimoto) have been serving for nine and seven years, respectively, and have demonstrated a lack of independence from Mr. Kishimoto